Impact investing Focus areas

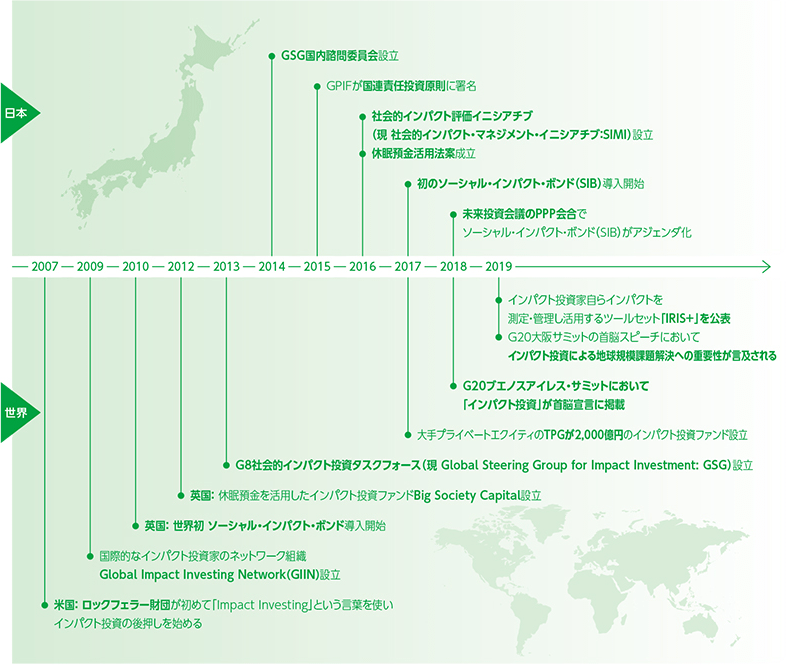

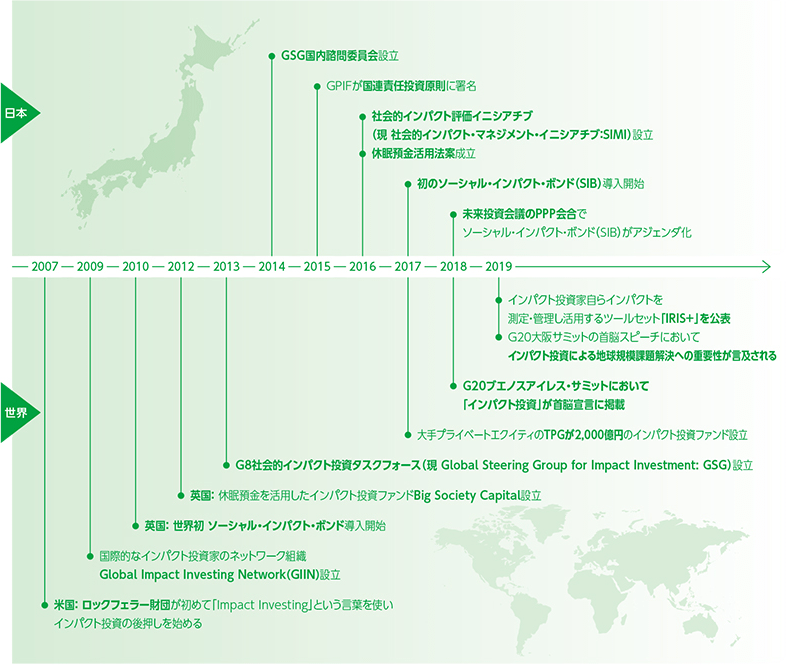

Acting from the standpoint of an organization that has played a central role from the dawning of the age of impact investing in Japan to the building of the ecosystem, SIIF creates successful examples of impact investing in partnership with important stakeholders. We are nurturing human resources and organizations involved in impact investing, and using research and policy proposals to put in place the required environment for the promotion of impact investing. We are also actively participating in development processes for shared rules and methodologies related to impact investing that are moving forward globally.

Impact investment is investment that aims to generate positive and measurable social and environmental impacts in addition to financial returns. Traditional investing is measured on the two dimensions of risk and return, but impact investing is based on measuring the three dimensions of risk, return, and impact.

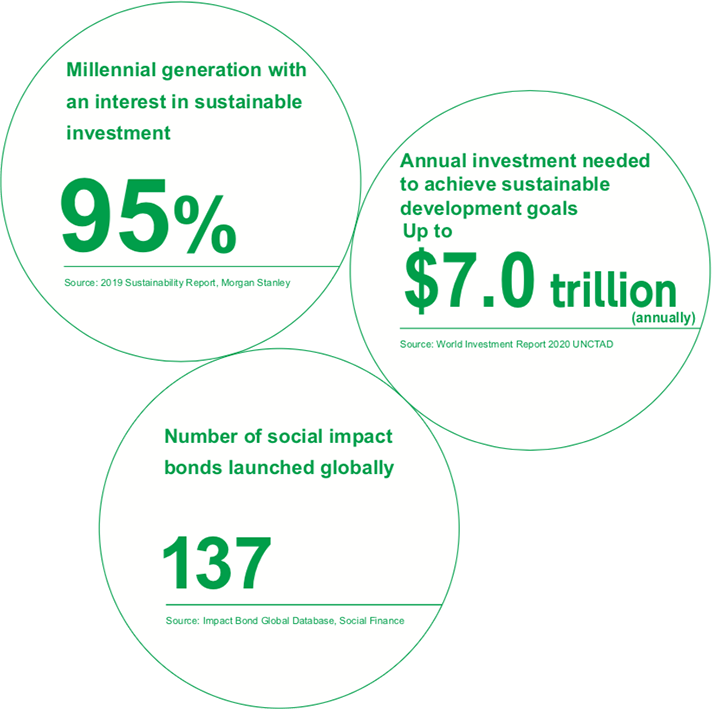

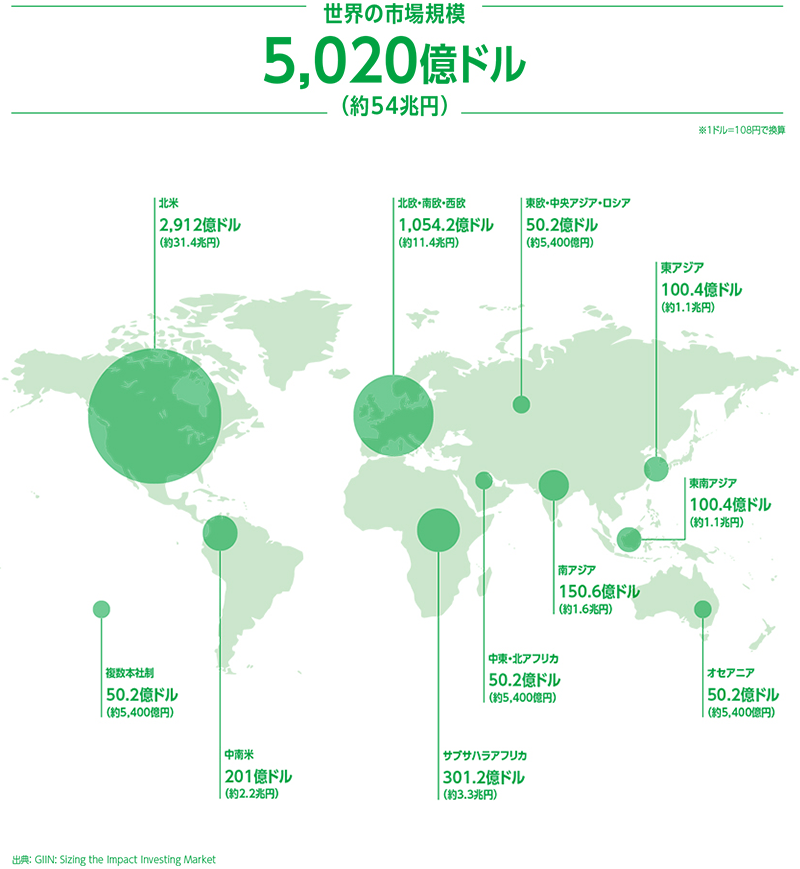

It is estimated that a maximum of $7 trillion is needed annually to achieve the Sustainable Development Goals promoted by the UN, and there is considerable expectation that the use of private funds will help accomplish this. Moreover, the interest of millennials in social issues is growing, and impact investing is being viewed as a market with growth potential.

The Nippon Foundation ‘Social Change Makers’ Hataraku FUND Single mother support project Conducted Japan’s first survey into consumer awareness of impact investing

Overview of impact investing activities

Three-dimensional investment structures experiencing global growth

Why is impact investing necessary today?

Case studies

Assists in the generation of social impacts as an intermediary support organization.

Five strategic themes for accomplishing our mission

Social impact bonds (SIB)

####タイトル####

- ####DT####

- ####DD####

- ####DT####

- ####DD####

- ####DT####

- ####DD####

####タイトル####

- ####DT####

- ####DD####

- ####DT####

- ####DD####

- ####DT####

- ####DD####

####タイトル####

- ####DT####

- ####DD####

- ####DT####

- ####DD####

- ####DT####

- ####DD####